Business Debt

Restructure Experts

Business Debt Restructure Experts

Cashflow by

-

In the industry since 2006

-

Attorney Network of 500+

-

Restructured over $1B in Debt

-

Saved 12,000+ Businesses from Ch.7 & 11 Bankruptcy

Our Latest Success Stories

About

We are committed to helping you get your business revenue back. That means providing a dedicated business debt expert team & attorney that will work tirelessly to deliver the result you want – your debt restructured. And we’ll be with you from start to finish.

Commonly Asked Questions

We provide business debt restructuring for businesses with Merchant Cash Advances only. We specialize in MCA negotiations, making us the best choice in the country for businesses restricted by MCA terms.

Every business's debt is unique and the restructuring plan is on a case by case basis, however in a general term, we analyze your debt commitments and your payment schedules, and based on the lenders, we can determine how much of the commitments can be renegotiated.

Our attorneys bundle restructuring agreements when they submit new terms to lenders, giving you the best new terms possible to open up your business cash flow, along with getting you out of the debt faster than on your own.

Your daily or weekly Merchant Cash Advance payments are usually exorbitantly high, and when we renegotiate your MCA terms, the new payment will be lower than what you are paying now, the principal balance will be lower, and our service charges will be already included in your lower payment.

We are in the business of helping small to medium-size businesses, making sure they stay running & keep their cash flow profitable.

Do not reverse consolidate your loans, which is taking out a new Merchant Cash Advance to pay for your other advances. This significantly raises the factor rate / interest on the initial principal, costing you 2-3 times the original amount.

Also, make sure to include all of your business debt to your financial advisor, and include a history statement for each MCA you may have.

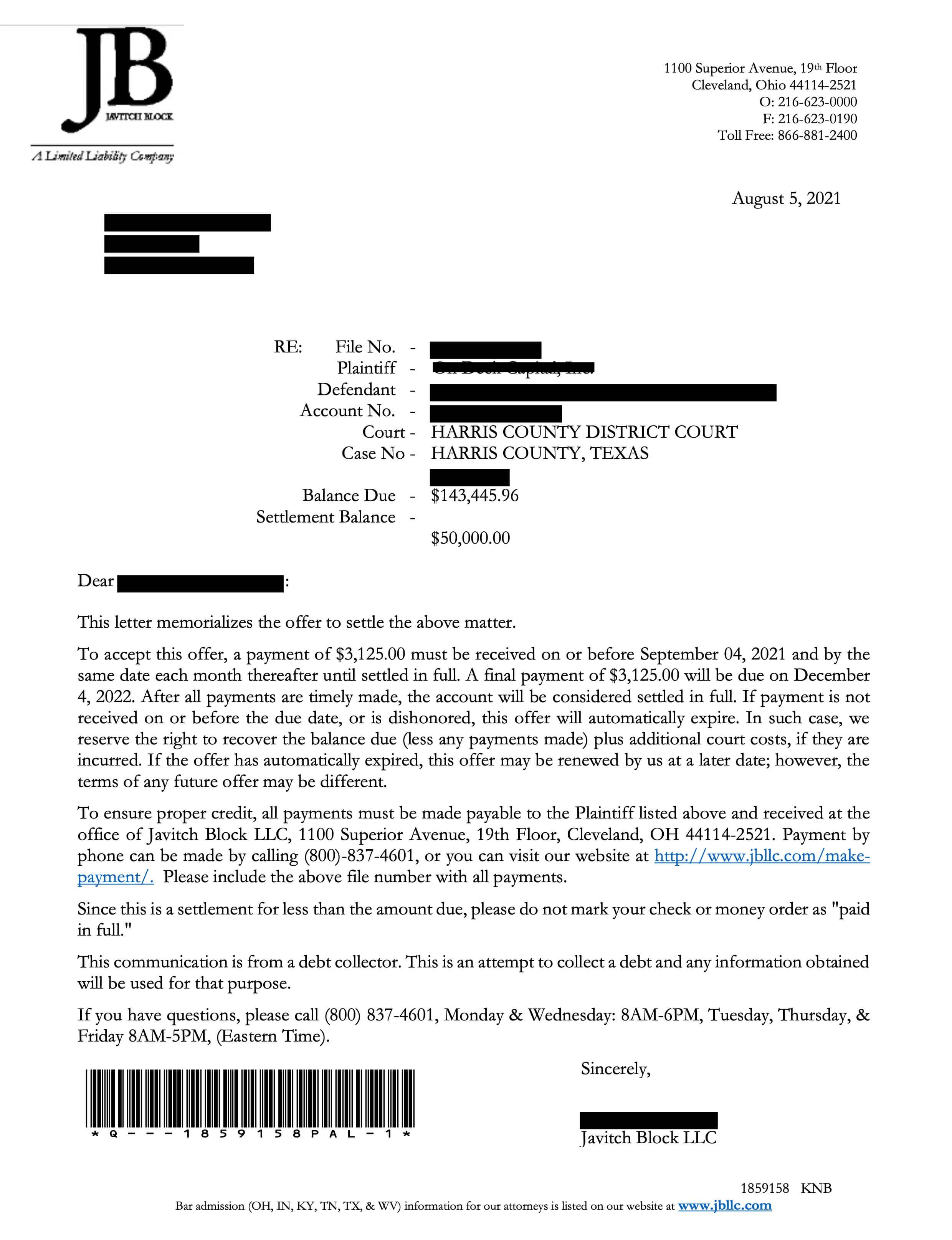

I was soooo stressed out about all of the Advances I took to keep our Home Health business afloat. It was such a relief to get all of that restructured by Eastern Financial Partners; my clients & I will be forever grateful.

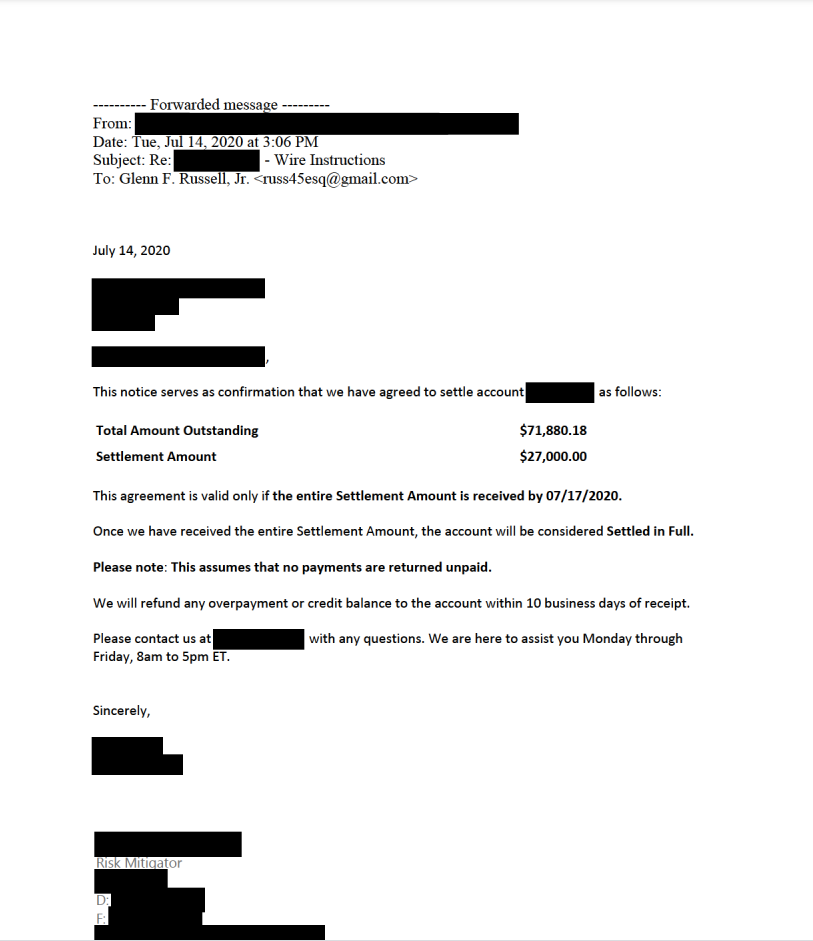

Interest Saved: $71k

Program Length: 12 months

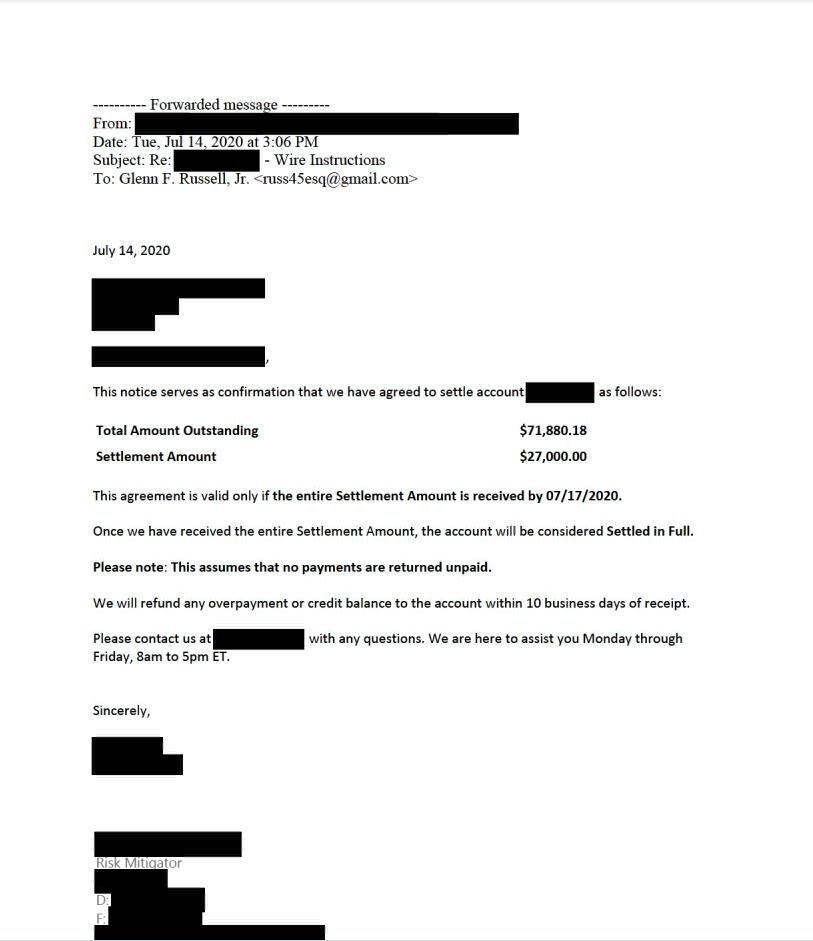

Being able to trust them to do their job allows you to take care of what's important in your business.

Interest Saved: $51k

Program Length: 16 months

Within 3 months I started to see how the debt was going down and I felt this huge weight lift off of me.

Interest Saved: $22k

Program Length: 9 months

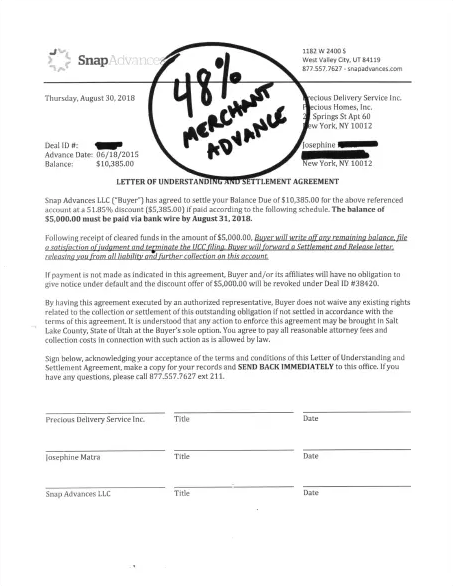

Over the past few years, our business suffered from a series of unexpected financial setbacks—of which the pandemic was the final straw. We are beyond grateful to have been introduced to Eastern Financial Partners.

Interest Saved: $41k

Program Length: 8 months

Sign up for our semi-monthly newsletter, a great resource for healthy business finance 💵